The Venture Capital Risk and Return Matrix - Industry Ventures

4.8 (336) In stock

Generally speaking, we found that the likelihood of achieving expected returns is not simply a function of high multiples. In fact, it varies depending on risk profile. For direct investments, loss rates and holding periods play a significant role. For venture fund counterparts, the same holds true, but exit strategies – whether through IPO or M&A – and capital-deployment timing also matter a great deal.

10+ Venture Capital Risk Management Templates in PDF

スタートアップ経営の鉄則】~代替卵ユニコーンEat Justや培養肉Upside Foodsが陥った罠に共通する「教訓」

The changing face of corporate venturing in biotechnology

Market-Technology-Execution Risk Matrix and team execution

Ultimate FAQ:venture capital investment, What, How, Why, When

Should I Invest in Agricultural Start-up Business Ventures?

The VC and PE cycle: the roles of investors, VC or PE firms and

Can I fundraise in COVID times ? — the “New” Fundraising Matrix, by specht.p

Risk-return matrix for firms.

スタートアップ経営の鉄則】~代替卵ユニコーンEat Justや培養肉Upside Foodsが陥った罠に共通する「教訓」

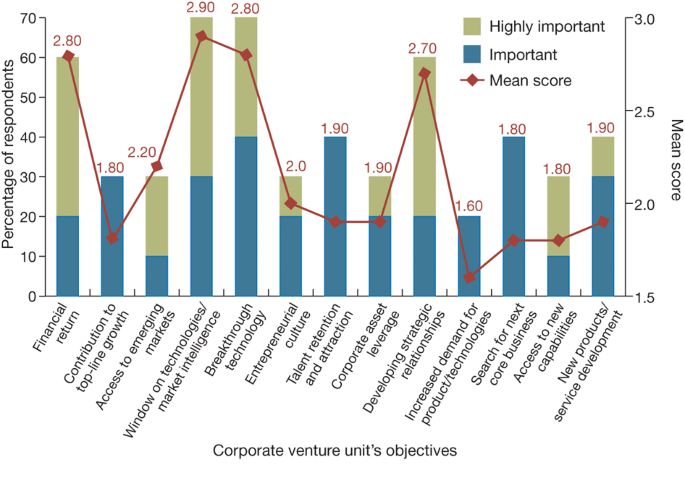

Rethinking the Role of Corporate Venture - Terem

Early-stage valuations are down 20-30%. They should ideally fall

スタートアップ経営の鉄則】~代替卵ユニコーンEat Justや培養肉Upside Foodsが陥った罠に共通する「教訓」

A Guide to Venture Capital Investment Stages

A Comprehensive Guide to Securing Venture Capital Funding for your Startup

VCs have spoken: the 10 US states dominating venture capital in 2021

Venture Capital Firm Structure: How Does A VC Firm Work? – Feedough

Skull On Fire Sweatpants Black by BSAT

Skull On Fire Sweatpants Black by BSAT Push-up-BH mit variablen Trägern

Push-up-BH mit variablen Trägern Sunshine Shimmer Bikini Collection – The Tropical Society

Sunshine Shimmer Bikini Collection – The Tropical Society Doc McStuffins - Plugged In

Doc McStuffins - Plugged In Mini Houndstooth Flare Pants - Black/White

Mini Houndstooth Flare Pants - Black/White SAAKO Classic Design Printed Dress, Loose Bohemian Style Dress.(White,XL) : : Clothing, Shoes & Accessories

SAAKO Classic Design Printed Dress, Loose Bohemian Style Dress.(White,XL) : : Clothing, Shoes & Accessories