Low-Income Housing Tax Credit Could Do More to Expand Opportunity

4.6 (433) In stock

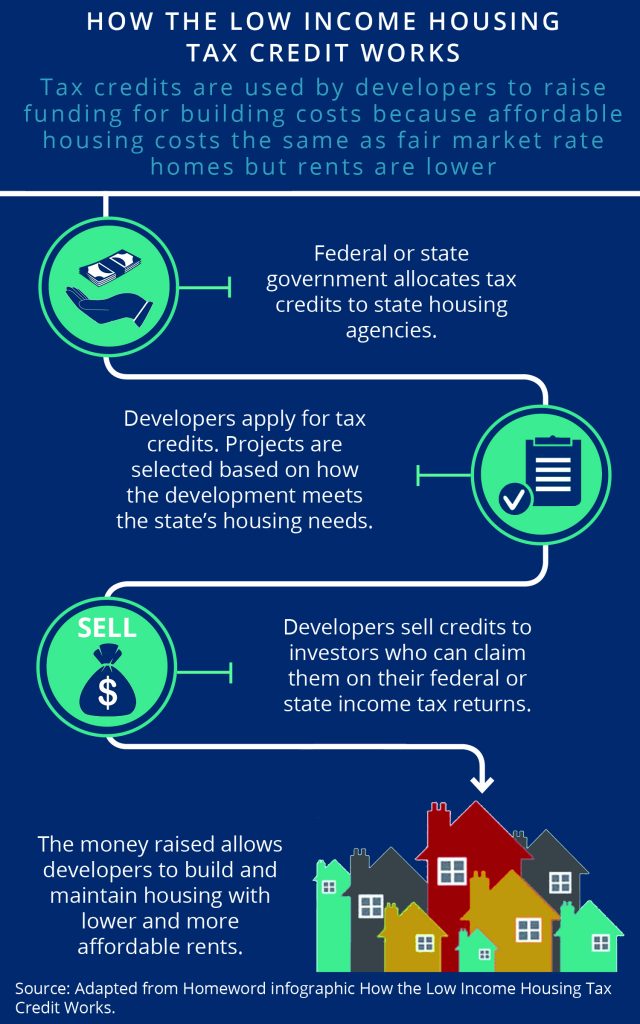

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

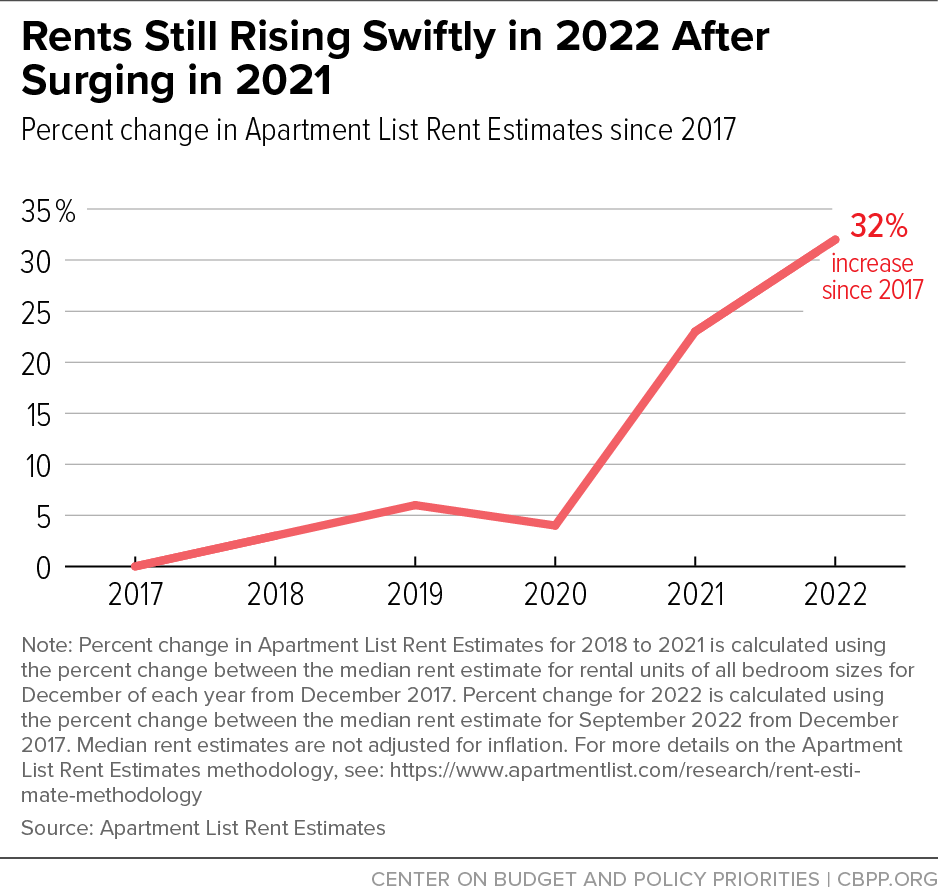

Addressing the Affordable Housing Crisis Requires Expanding Rental Assistance and Adding Housing Units

Low-Income Housing Tax Credit Program

Closing The Divide - Enterprise + FHJC, PDF, Affordable Housing

Incentivizing Developers To Reuse Low Income Housing Tax Credits - Federation of American Scientists

Low-Income Housing Tax Credits: Why They Matter, How They Work and How They Could Change - Zillow Research

How to Improve the Low-Income Housing Tax Credit

State and Local Strategies to Improve Housing Affordability

Housing Mobility Strategies and Resources

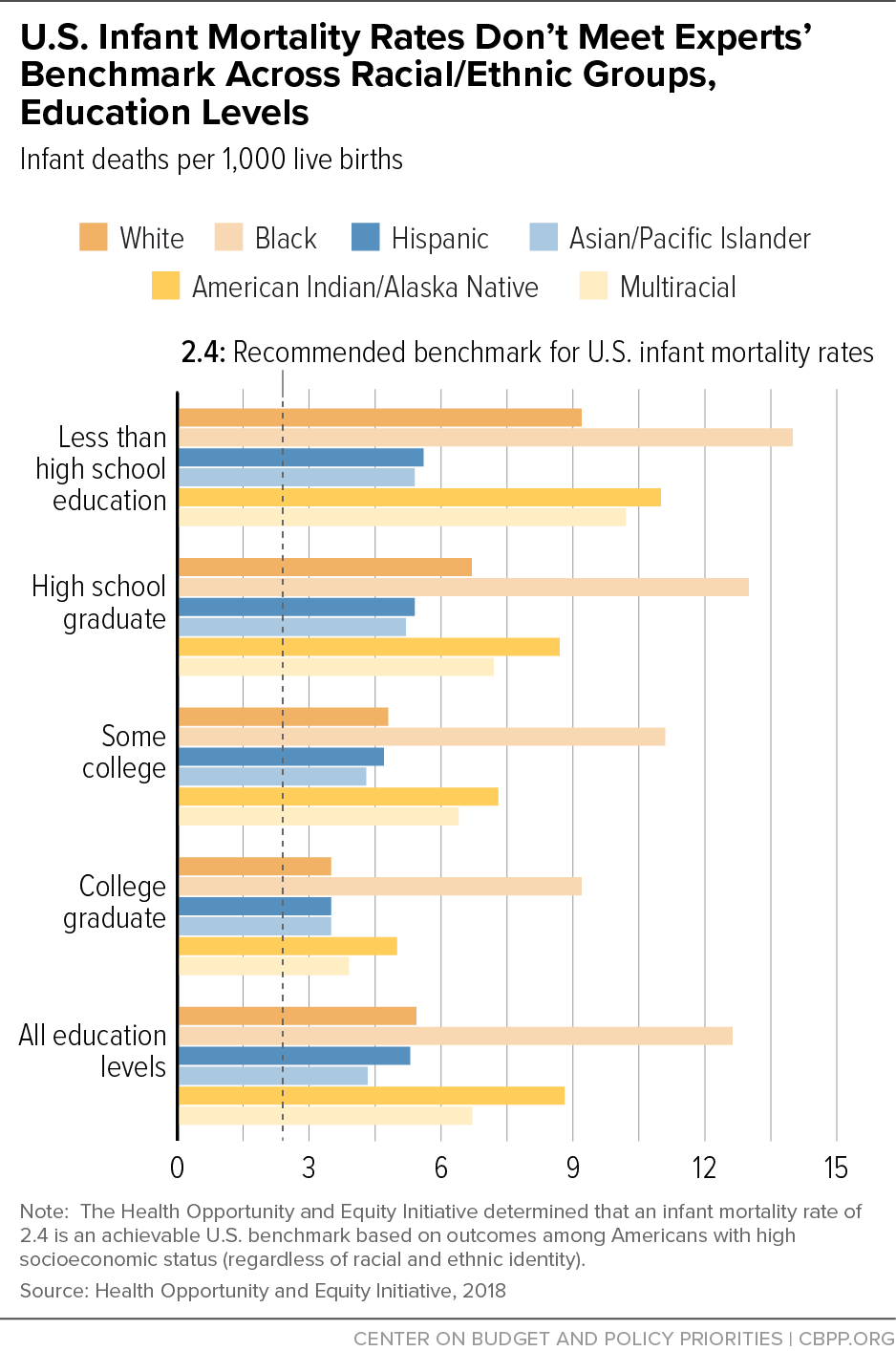

Better State Budget, Policy Decisions Can Improve Health

LIHTC Provides Much-Needed Affordable Housing, But Not Enough to Address Today's Market Demands

Equity and Climate for Homes - Circulate San Diego - Staging Environment

Using LIHTC to Expand Access to Opportunity

Low income - Free business and finance icons

Low-Income, Strong Skills - NCEE

How To Make Low-Income Housing Work As A Real Estate Investment?

Fewer young kids, more seniors in low-income households: census

$1518 Extra for Seniors With Low Income in Canada: Reality Check